Loading...

Frequently Asked Questions

Here are some common questions we have been asked.

We are always eager to receive and respond to feedback and questions, so please don't hesitate to let us know how we can assist!

Contact Us Today!

Does CMS offer Interstate LTL or TL Trucking?

Absolutely CMS and the UniGroup Network offer a full array of Transportation solutions for LTL and TL logistics. Our services are not limited to palletized and packaged products either. Many of our clients select CMS for our expertise in transporting fragile and high value items that require: Pads, Straps, and other unique equipment.

Contact our Team today to learn more about our transportation services.

- Full Truckload

- Palletized Air-Ride Van Service

- Blanketwrap Air-Ride Van Service

- Port & Container Drayage Service - Less than Truckload

- Palletized Air-Ride Service

- Palletized Common Freight Service

- Blanketwrap Air-Ride Service

- Liftgate, Whiteglove and Final Mile Service - Parcel Contract Rate Pool Service

How are route, crew or field service times calculated and charged?

Our field service teams are comprised of local drivers, moving crews, riggers, technical installers, supervisors and of course the trucks and equipment we operate. When clients request service we first identify the equipment and field service team members needed for the scope of work. On repeat account business we may create flat rates or rates that are tied to non-hourly metrics however this is only the case in higher volume scenarios. In most cases our field service teams are dispatched on an hourly basis. We offer 3 basic methods of calculating service times, all of our calculations are based on the GPS coordinates which are logged in our vehicles by a 3rd Party provider called Lytx. Lytx offers a front and rear facing camera system which is equipped with vehicle telemetry and ELD compliant features. We gather the GPS data from Lytx for the automation of our billing and all records are auditable through our web portal or when required directly from Lytx for 3rd party accountability.

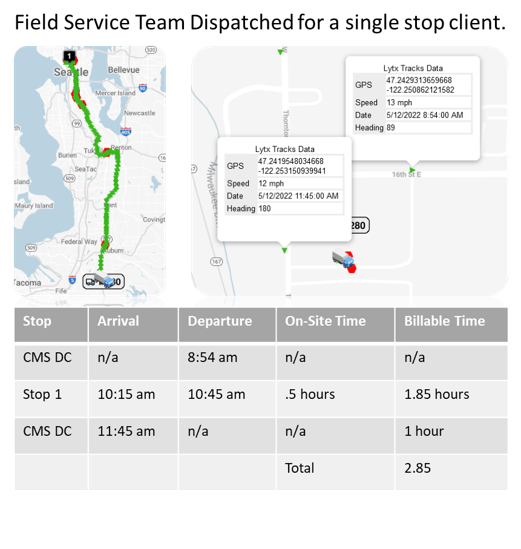

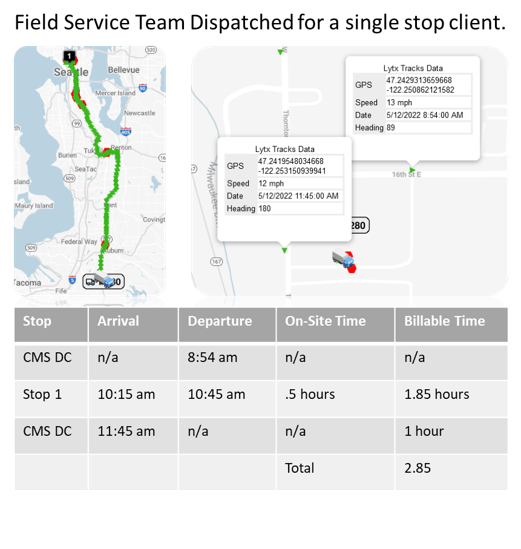

Portal to Portal

Portal to portal is a term used frequently in transportation which means that the hourly charges for service start the time the field service team leaves their station of dispatch. The station of dispatch is generally our Distribution Center. This time continues until the fields service team returns to the station of dispatch. Portal to Portal time generally will also include the time required to load, prepare and clean up at the beginning and end of the various requested services. Below is a simple graphic demonstrating portal to portal time.

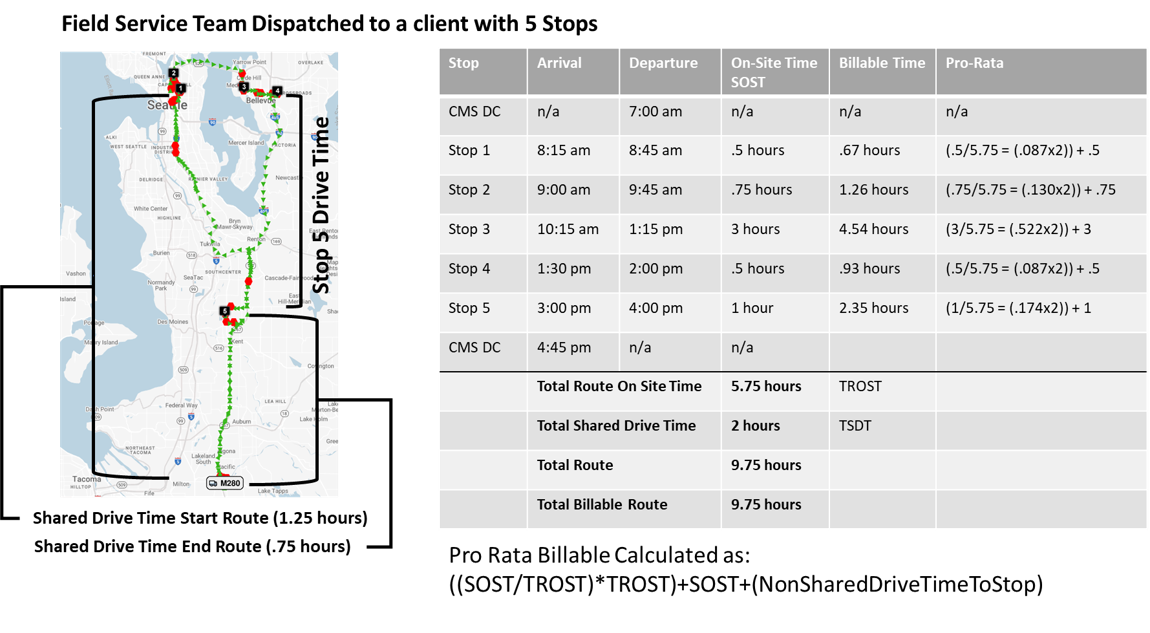

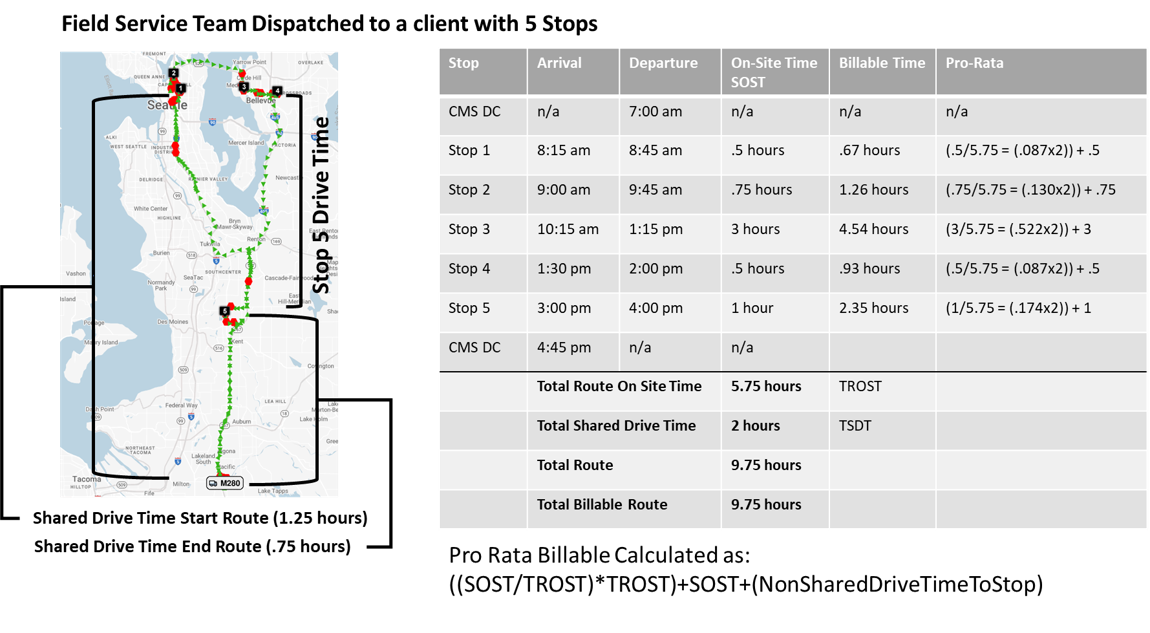

Shared Route Time

Shared route time is a term used by our team when we are dispatching our field service teams to different stops or services for the same client but with varying cost centers, budgets, or accounting requirements. This method captures the Portal to Portal route time however the drive time from our station of dispatch and returning to our station of dispatch is then combined into a shared pool. The on-site time of the entire route is then combined together and this pooled drive time is then re-distributed back to the various stops based on their pro-rata share of on site time. This method ensures that the larger jobs are responsible for the majority of drive times accrued. Below is a simple graphic demonstrating shared route time.

Unit Based (Non-Hourly)

Unit based calculations are generally reserved for larger volume distribution clients or clients with high volume campus or field service needs. In these cases we generate our rates by a single or combination of rates against the following metrics. Weight, Miles, Service Zone, Head Count (Such as Number of Employees Moving), Item Count (Such as pallets, crates etc..) or dimensional based details such as Linear Feet of truck use or Cubic Feet of Shipment Size. In these scenarios we generally will also include a set amount of on-site time into the flat rate however additional on-site time accrued beyond this initial figure is charged at the stated hourly rates.

How Can I Change My Password?

How to reset your password

If you are logged in and simply wish to change your current password you may navigate to your contact page and click the Reset Password Button found at the top of the page, you may also use the following link here: Password Reset

If you are logged out and unable to remember your password you may request a reset through the login screen. You will be required to use your username and email associated with your account. Once submitted you will receive a temporary password via email along with a reset link to establish a new password.

How can I find copies of an Invoice?

There are several ways to find orders, projects and invoices.

Option 1. Find Tool

The fastest method is to navigate to the search bar at the bottom of your menu.

- Type in the Order / Invoice Number and this will return the records.

- Navigate to the Docs Tab of the order or project where you will find the option to download Invoices which have been released.

Option 2. Reports

By Navigating the the Reports Area in the menu under your account, you will find options to generate reports by date range.

- First select the date range in which the invoice is within.

- Select the type of report.

- All Invoices will return all released invoices in the period selected.

- Aging Open Invoices will return only un-paid invoices in the period selected.

- Aging All Invoices will return all invoices within the period selected and show the aging date including those which are paid.

- Click the Generate Report Button at the bottom of the page.

- In the new window navigate to the invoices which you wish to view and click on the Dollar Amount ($XXX.XX) which will open a copy of the invoice in a new window.

- An added option is to check the Add notes to report option at the top of the page which will generate PDF invoices for each invoice and include all invoices within the report.

Option 3. Projects

If your account is billed / invoices on a weekly or monthly basis you are likely to find projects which contain batches of invoices and orders based on the time period of your billing cycle. To find this billing information:

- Navigate to the menu and expand the Projects Item, expanding each week or month until you have located your project OR using the find option at the bottom of the menu simply type in the name of the project, month, or week number.

- Click on the name of the Project once you have located the correct record.

- Navigate to the Docs Tab within the project where you will find uploaded copies of all of your billing spreadsheets for that period.

How can I find out what my current account balance is?

To find your current account balance we recommend running an aging report to view all outstanding invoices/billing and the dates they were submitted for payment.

By Navigating to the Reports Area in the main menu under your account, you will find options to generate reports by date range.

- NO Date range is required for the Aging Report as this will show all Invoices that are currently un-paid in our system.

- Select the:

- Aging Open Invoices will return only un-paid invoices in the period selected.

- Aging All Invoices will return all invoices within the period selected and show the aging date including those which are paid.

- Click the Generate Report Button at the bottom of the page.

- In the new window navigate to the invoices which you wish to view and click on the Dollar Amount ($XXX.XX) which will open a copy of the invoice in a new window.

- An added option is to check the Add notes to report option at the top of the page which will generate PDF invoices for each invoice and include all invoices within the report.

How do I add/update the email address of the people on my account, who receive invoice emails?

Our system generates many different types of emails, and you will need to contact our support team to update Client contact information.

Often times our clients may have different lines of business, departments or internal routing that requires us to direct email correspondence into different accounts.

To change the default email for Invoice Correspondence please Click Here to submit your request, or submit emails to Support@VanLinelogistics.com with your requests.

How do I find out what is currently held in your warehouse(s) for my account?

All of your account Inventory is located in the Inventory Control option of the Main Menu. By navigating to this area you will be able to view the master items held in the various locations your account is operating from (Geographically by Warehouse ID). These master items may then be expanded to view the nested items within each master or parent.

An alternative to viewing the live inventory listing is also to generate reports for your account. By navigating to the reports tab under the main menu you are able to generate reports to track inventory transactions. On Hand options will show a current report at the given time while date based reports will only show transactions which occurred between two date ranges.

What are system shortcuts and how can I create them?

Each account's credentials allow different levels of access throughout the system. Your account may or may not have access to system shortcuts. Much like a browser is able to save bookmarks and shortcuts our system will also allow a user to save a page to a shortcut list.

Once logged in if you see a shortcut button in the bottom right hand side of your window you have the ability to create shortcuts.

Simply click this button and enter a title for the shortcut you wish to save. This will create your shortcut link to the current page you are on with the title you have given.

You will now have access to this link from your shortcuts menu area.

What is the difference between Additional Valuation, Liability Rates and Liability Limits?

Cargo Liability Limits (often listed on certificates of insurance), Additional Valuation and Released Liability Rates are all very different things. A common misconception is that the Cargo Liability Limit represents the protection one might have on a shipment while in transit. That is not however the case.

Rates vs Limits

General Cargo Liability Limits are the insurance limits that apply as a maximum to the goods on a truck or in possession of another party. These limits are most frequently referenced in the case of a

complete loss or partial loss due to accidents etc. This is not however the rate at which your cargo is covered in cases of loss or damage. The

Released Cargo Liability Rate is used to determine the maximum amounts a shipment and/or items are covered to in the case of Loss or Damage.

How are Rates Calculated?

Released Cargo Liability Rates can come in different methods of calculation. Most frequently carriers and warehouses list their rates of liability coverage in the market currency (USD) multiplied by the item weight (Lbs). This calculation is almost never made from the shipment weight but rather the weight PER ITEM. As such most Uniform Bill of Ladings will have statement which lists the common phrase per item per lbs.. While there are carriers who offer rates by other methods (IE CUFT, CWT etc.) these are not very common. It is important to understand this because while it clearly is an issue if you previously thought the Maximum Limit was your coverage, it is equally problematic if your shipment has either a high Class / Billable Weight or if your shipment has multiple items and the majority of value is held in a lighter weight item. In these cases you might believe your rates will produce a higher level of coverage that it really will.

What are Common Rates?

Our Released Cargo Liability Rates like almost all providers

is set at $0.60 per lbs per article for general services. We offer our clients the ability to create contracted increases to that limit by commodity, with a default at

$0.60 with a maximum of $15.00 per lbs per article. As you work with various carriers you will find that these limits are very wide. In cases of Truckload shipments where the carrier has no physical interaction with the freight you will often find NO LIABILITY or a $0.00 per lbs per article. This is generally the case when a carrier only offers a maximum limit in the case of a catastrophic loss or complete loss. Other carriers that operate in very high dollar markets, or interacting with commodities of high value nature (Air-Ride Vanlines) start coverage with rates such as $5.00 per lbs per article. What is interesting to note is that these rates have not changed for nearly half a century. Older carriers dating back into the 1970's may have started business with rates at $0.60 per lbs per article that that is still the same rate. This is a valid item to note because uniformity in the market does not mean that the rate is even close to accurate for common commodity valuations as annual inflation rates have clearly surpassed any correlation to these rates.

What is Additional Valuation?

When a client determines

that the Liability Rate is not sufficient many carriers then offer Additional Valuation

Protection. This product/service is sold to offer added coverage on a shipment for a

higher amount to match the actual replacement value of the goods rather than a general

rate/amount tied to the weight of goods. Additional Valuation is sold based on

the commodity and starts at $6.50 per Thousand Dollars of Requested coverage up

to $20.00 per thousand for higher risk commodities. IE a Pallet of Glass

Sculptures worth $10k are not in the same commodity class as a pallet of nails

worth $10k due to the inherent risk difference.

Ultimately the nature of your shipments, storage plan, handling and packing methods will greatly play a role in the determination of what the correct solution is for your needs. If you would like to discuss more about this topic, please contact our team!

Why use moving crates?

Our clients find that there are five significant reasons to choose Crates over conventional cardboard boxes.

Security & Safety

Crates provide improvment in crush resistance, puncture proofing and securement. If you desire to protect the items you are packing Crates are substantially better than boxes.

Efficiency

On many relocations clients opt to pack or unpack their own contents. During this process Crates with folding lids and dollies greatly decrease the time consumed in Packing and Un-Packing. Beyond just the time you will save in Packing & Un-Packing, the teams assigned to the movement will save hours and hours on the transportation of your contents as Stacked Crates on Dollies are much faster to move than boxes!

Environment

Conventional Cardboard Boxes generally have a very short lifetime. We take great care in sourcing our materials from recycled paper providers, however boxes can only be used on one relocation. Save Trees and consider the Green Method of Moving with Crates!

Urgency

Have you ever moved before and found that it took weeks, months or years to finally un-pack all your boxes? Another great reason to use crates is that these rental terms force employee's, staff and team members to expedite the process of packing and un-packing creating urgency in gettng your workspace back to operational status!

Cost

While each relocation has very different timelines and requirements, many moves find significant savings in the cost of crates over the expense of purchasing boxes and the required recycling and/or disposal of those purchased materials. Our clients generally find that any crates used for durations under 30 to 60 days will produce a savings over the actual purchase cost of Boxes.

Crates provide improvment in crush resistance, puncture proofing and securement. If you desire to protect the items you are packing Crates are substantially better than boxes.

Efficiency

On many relocations clients opt to pack or unpack their own contents. During this process Crates with folding lids and dollies greatly decrease the time consumed in Packing and Un-Packing. Beyond just the time you will save in Packing & Un-Packing, the teams assigned to the movement will save hours and hours on the transportation of your contents as Stacked Crates on Dollies are much faster to move than boxes!

Environment

Conventional Cardboard Boxes generally have a very short lifetime. We take great care in sourcing our materials from recycled paper providers, however boxes can only be used on one relocation. Save Trees and consider the Green Method of Moving with Crates!

Urgency

Have you ever moved before and found that it took weeks, months or years to finally un-pack all your boxes? Another great reason to use crates is that these rental terms force employee's, staff and team members to expedite the process of packing and un-packing creating urgency in gettng your workspace back to operational status!

Cost

While each relocation has very different timelines and requirements, many moves find significant savings in the cost of crates over the expense of purchasing boxes and the required recycling and/or disposal of those purchased materials. Our clients generally find that any crates used for durations under 30 to 60 days will produce a savings over the actual purchase cost of Boxes.

Quality Delivered

CMS Logistics

1613 132nd Ave East Ste 100

Sumner WA 98039

+1 253-437-3986

support@vanlinelogistics.com

© VanlineLogistics.com, 2026.

CMS Logistics - USDOT: #505087 | MCC: #242241 | WUTC: #HG045867 | SCAC:CEMW

This website, portal and system uses Cookies. By using our website, portal and system, you agree to the use of cookies.Accept

For more information please review our Terms of Service and Privacy Policy.

For more information please review our Terms of Service and Privacy Policy.